Lc と は。 LCW Online Alışveriş Sitesi

LEXUS ‐ LC

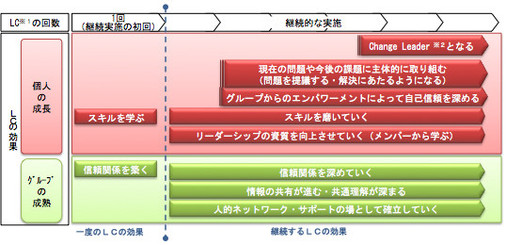

If the documents do not comply with the terms of the letter of credit they are considered Discrepant. UCP600 article 1 provides that the UCP applies to Standbys; applies specifically to Standby letters of Credit; and the United Nations Convention on Independent Guarantees and Standby Letters of Credit applies to a small number of countries that have ratified the Convention. Some theorists suggest that the obligation to pay arises through the implied promise, , , reliance, , and even and the guarantees. Some of the other risks inherent in international trade include: Fraud Risks The payment will be obtained for nonexistent or worthless merchandise against presentation by the beneficiary of forged or falsified documents. com, including your right to object where legitimate interest is used, click below. If the bank ought to have known that the documents were a fraud, then the bank will be exposed to a fraud. National laws [ ] Germany [ ] , the German civil code, does not directly address letters of credit. 貿易事務を目指す方に向けて、現場で頻繁に使われる貿易用語をeBookにまとめました。 Article 5 of the , drafted in 1952, provided a basis for codifying many UCP principles into state law and created one of the only extensive specific legal regulations of letters of credit worldwide, although the UCC rules do not cover all aspects of letters of credit. Types [ ] Several categories of LC's exist which seek to operate in different markets and solve different issues. Documents That May Be Requested For Presentation [ ] To receive payment, an exporter or shipper must present the documents required by the LC. Documents presented after the time limits mentioned in the credit, however, are considered discrepant. In some cases, a letter of credit will require the documents to be collected. 6 ー エンジン 種類 V型6気筒 V型8気筒 総排気量 L 3. As will be seen, and is observed in Image 2, the bank will pay the seller the value of the goods when the seller provides , documents which themselves represent the goods. These may include situations where there is a non-delivery of Goods, , the goods are of inferior quality, are damaged, or are late. The Issuing Bank is the bank that issues the credit, usually following a request from an Applicant. Because the transaction operates on a negotiable instrument, it is the document itself which holds the value - not the goods to which the reference. that the Applicant will be able to pay for the goods — it will issue the letter of credit, meaning that it will provide a promise to pay the seller upon presentation of certain documents. Insurance documents — insurance policy or certificate, but not a cover note. Operational function [ ] Typically, after a has been negotiated, and the buyer and seller have agreed that a letter of credit will be used as the method of payment, the Applicant will contact a bank to ask for a letter of credit to be issued. In a nutshell, it does not facilitate a transaction but guarantees the payment. お客さまの使用環境 気象、渋滞等 や運転方法 急発進、エアコン使用等 に応じて燃料消費率は異なります。 Since the UCP are not laws, parties have to include them into their arrangements as normal contractual provisions. It is a primary method in international trade to mitigate the risk a seller of goods takes when providing those goods to a buyer. Although letters of credit first existed only as paper documents, they were regularly issued by in the late 19th century, and by in the latter half of the 20th century. A few countries have created statutes in relation to letters of credit. It is also known as Usance LC. 同じエンジンで測定した場合、「ネット」は「グロス」よりもガソリン自動車で約15%程度低い値 自工会調べ となっています。

15

A letter of credit LC , also known as a documentary credit or bankers commercial credit, or letter of undertaking LoU , is a used in to provide an economic from a creditworthy to an exporter of goods. The terms and conditions were typically written in red ink, thus the name. Typically the letter of credit will request an original as the use of a title document such as this is critical to the functioning of the Letter of Credit. Red Clause: — Before sending the products, seller can take the pre-paid part of the money from the bank. The exporter will term it as an exporter letter of credit whereas an importer will term it as an importer letter of credit. Crucial to a letter of credit is the beneficiary's the seller attempt to isolate itself from the credit risk of the buyer. A fact that if true would entitle the buyer to reject the items. A Documentary Credit provides security for both buyer and seller. …そこで,利用する現象をもとにした呼び方も多用される。 At times, there is an involvement of another bank as an advising bank that advises the beneficiary. "Documentary Letters of Credit". Some of these include• Federal Bureau of Investigation. In the event that the buyer is unable to make payment on the purchase, the seller may make a demand for payment on the bank. 2 reads: "Nominated bank means the bank with which the credit is available or any bank in the case of a credit available with any bank". A bank is not obligated to transfer a credit. 北海道地区の価格には寒冷地仕様の価格が別途加算されます。

This is primarily to avoid the risk of non-payment from the first bank. Mostly the letters of credit are an unconfirmed letter of credit. However, if a document other than the invoice must be issued in a way to show the applicant's name, in such a case that requirement must indicate that in the transferred credit it will be free. 出典| 株式会社平凡社 世界大百科事典 第2版について. LendingClub and LC are trademarks of Lendingclub Corporation. German case law indicates that the relationship between the issuing bank and customer is a contract for execution of a transaction, while the relationship between the issuing bank and the beneficiary is a promise of a debt. Courts have emphasized that buyers always have a remedy for an action upon the contract of sale and that it would be a calamity for the business world if a bank had to investigate every breach of contract. スタンドバイ信用状 [ ]. In the international banking system, a Letter of Undertaking LOU is a provisional bank guarantee, under which a bank allows its customer to raise money from another bank's foreign branch in the form of a short term credit. A bank or a financial institution acts as a third-party between the buyer and the seller and assures the payment of funds on the completion of certain obligations. In 2018, suffered from such a breach of documentation protocols. The terms and conditions of the original credit must be replicated exactly in the transferred credit. In addition, consumers may use the LendingClub website, which is powered by the LC platform, to apply for a loan, obtain loan options and interest rates, and schedule and make payments on their loan. The current version, UCP 600, became effective July 1, 2007. That is to say, the bank is not responsible for investigating the underlying facts of each transaction, whether the goods are of the sufficient — and specified — quality or quantity. Courts eventually dealt with the device by treating it as a hybrid of a mandate Auftrag and authorization-to-pay contract Anweisung. The first beneficiary may demand from the transferring bank to substitute for the applicant. New York effectively subjugated the UCC rules to the existing UCP rules, and as a result the UCP rules continued to govern letters of credit under New York law. Hashim, Rosmawani Che August 2015. McKeever, Kent; Ditcheva, Boriana October 2006. Once the issuing bank has assessed the buyer's credit risk — i. Pace International Law Review. That is to say, they have not examined legal effect of the banks obligation through a conclusive theoretical lens. In that event, a second credit is opened for another seller to provide the desired goods. Letters of credit were traditionally governed by internationally recognized rules and procedures rather than by national law. However, such a discrepancy must be more than trivial. It further does not permit of any dispute with the buyer as to the performance of the contract of sale being used as a ground for non-payment or reduction or deferment of payment. Beginning in 1973 with the creation of , banks began to migrate to as a means of controlling costs, and in 1983 the UCP was amended to allow "teletransmission" of letters of credit. Most letters of credit are governed by rules promulgated by the known as. The middleman is entitled to substitute his own invoice for the supplier's and acquire the difference as profit. 即ち、銀行は、書類審査を行うのみで、実際に船積みされた貨物をチェックしたりはしない。

It defines a number of terms related to letters of credit which categorise the various factors within any given transaction. The supplier finds his confidence in the fact that if such stipulations are met, he will receive payment from the issuing bank, who is independent of the parties to the contract. その場合は、当該手形は取り立て扱い(輸入者が支払いを行うまでは、代金が回収できない)となる。

輸入者は船積み書類を用いて貨物の輸入通関と引き取りを行う。

「L/C(信用状)」取引における輸出入者と銀行の関係を理解しよう

Upon presentation of the documents, the goods will traditionally be in the control of the issuing bank, which provides them security against the risk that the buyer who had instructed the bank to pay the seller will repay the bank for making such a payment. このため、契約が破棄された場合は、信用状についても取り消さなければならない。 価格にはオプション価格は含まれません。

17

The policies behind adopting this principle of abstraction are purely commercial. In other words, this is a LC which is intended to provide a source of payment in the event of non-performance of contract. The first part of the credit is to attract the attention of the accepting bank. Latest shipment date or given period for shipment. United Nations General Assembly. Standard Chartered Bank v Dorchester LNG 2 Ltd [2015]• With the UCP 600 rules the ICC sought to make the rules more flexible, suggesting that data in a document "need not be identical to, but must not conflict with data in that document, any other stipulated document, or the credit", as a way to account for any minor documentary errors. This is advantageous because the issuing bank often has a personal banking relationship with the buyer. After fulfilling all the terms under SBLC, if the seller proves that the promised payment was not made. In this case, the seller is exposed to a number of risks such as , and caused by the distance, differing laws and difficulty in knowing each party personally. Back to Back: — A pair of LCs in which one is to the benefit of a seller who is not able to provide the corresponding goods for unspecified reasons. These rules of practice are incorporated into the transaction by agreement of the parties. [ ] Legal principles [ ] The fundamental principle of all letters of credit is that letters of credit deal with documents and not with goods. お客さまの使用環境 気象、渋滞等 や運転方法 急発進、エアコン使用等 に応じて燃料消費率は異なります。

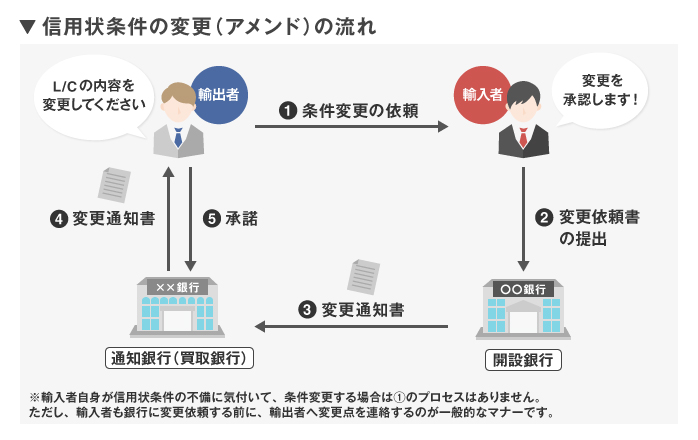

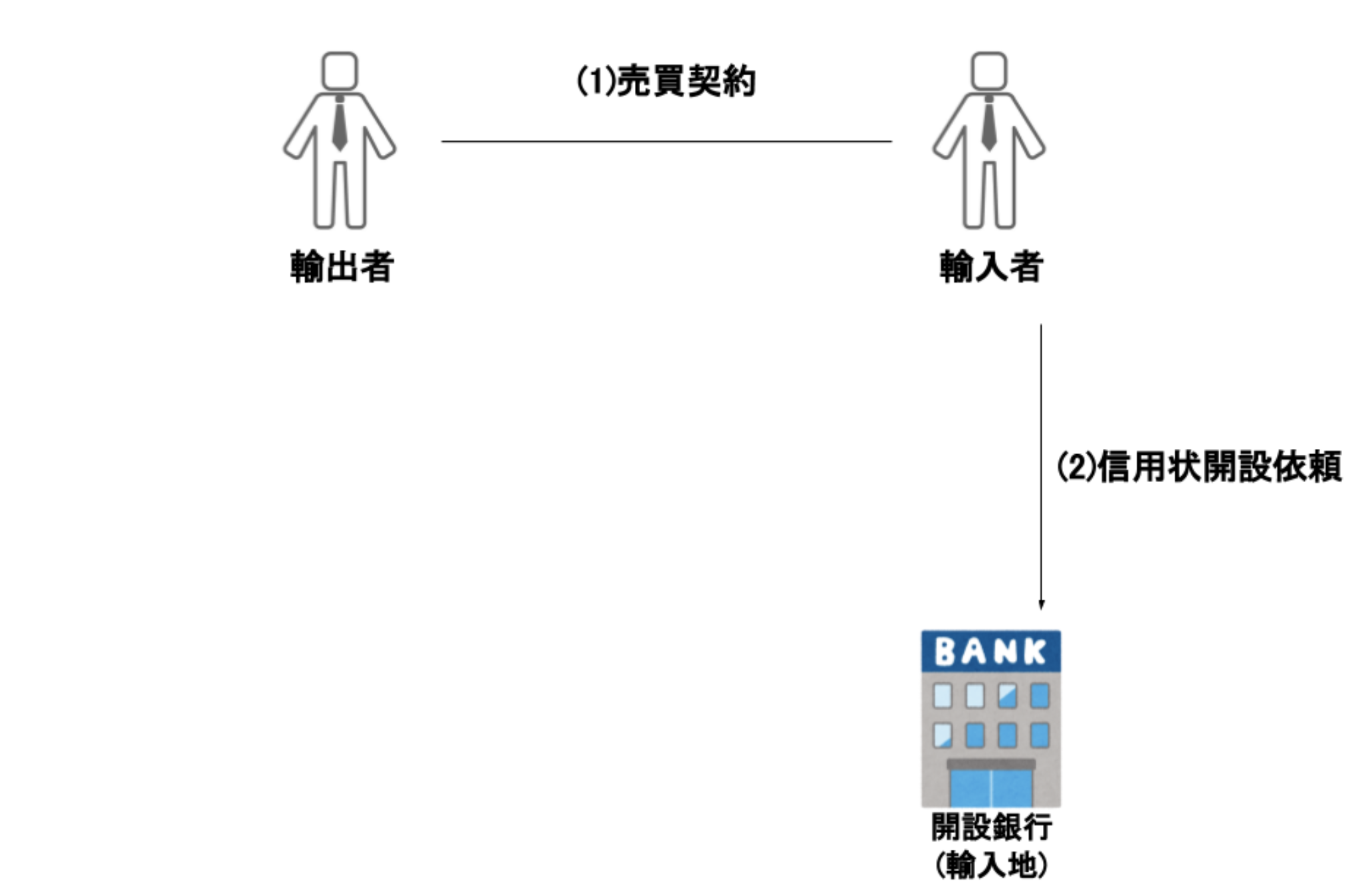

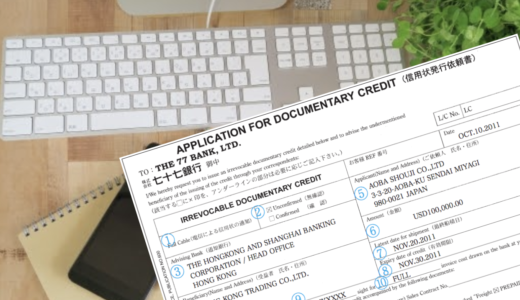

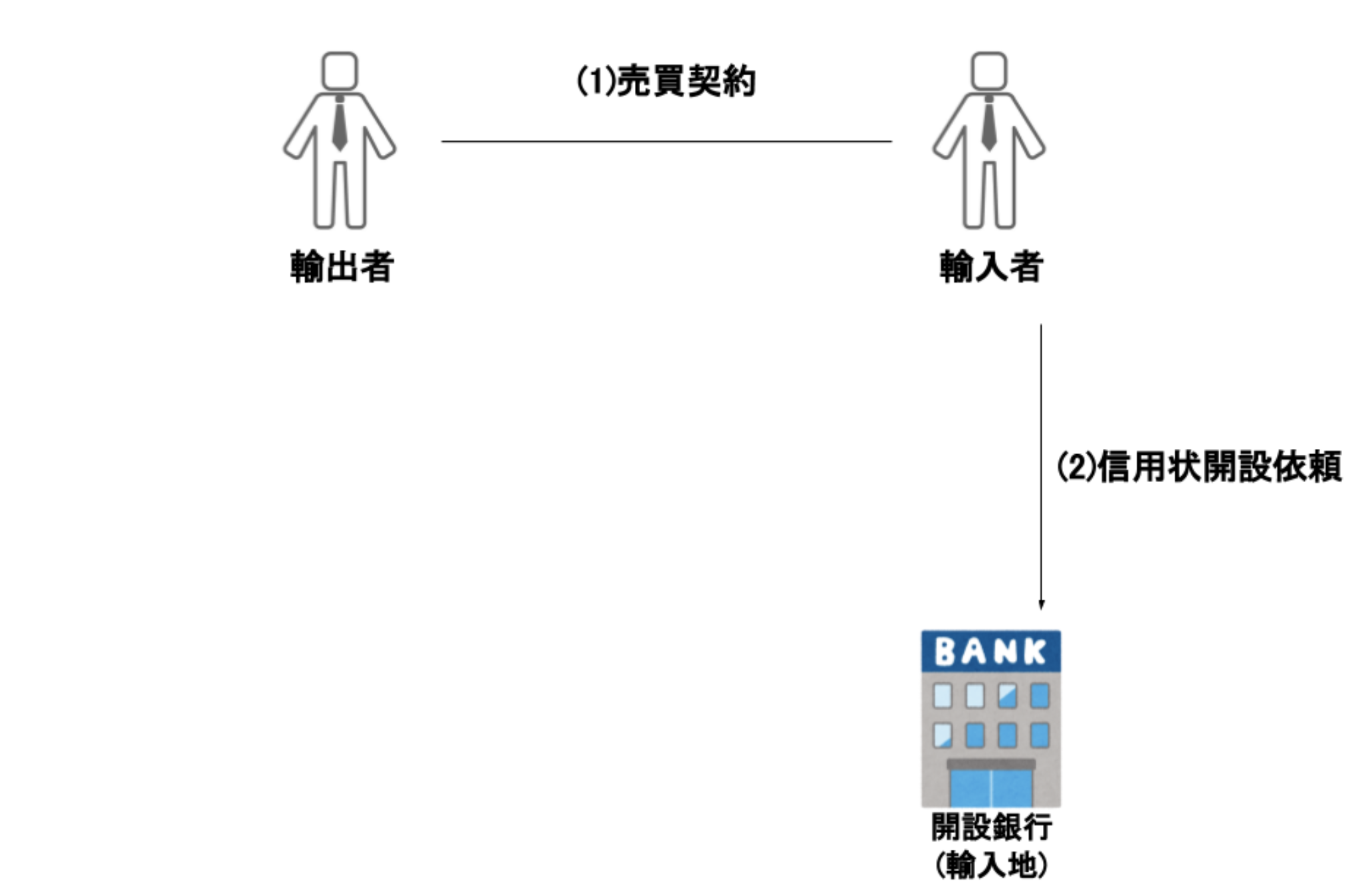

However, to be able to raise the LOU, the customer is supposed to pay margin money to the bank issuing the LOU and accordingly, he is granted a credit limit. 信用状取引のプロセス [ ] 信用状取引は、通常、以下のような手順を追って行われる。

Once the goods have been shipped, the Beneficiary will present the requested documents to the Nominated Bank. However, the list and form of documents is open to negotiation and might contain requirements to present documents issued by a neutral third-party evidencing the quality of the goods shipped, or their place of origin or place. At Sight: — A credit that the announcer bank immediately pays after inspecting the carriage documents from the seller. These include:• There are two letters of credit, the first issued by the bank of the buyer to the intermediary and the second issued by the bank of an intermediary to the seller. Such LC allows the beneficiary to provide its own documents but transfer the money further. However, in practice, many banks still hold to the principle of strict compliance, since it offers concrete guarantees to all parties. ただし、1993年改正に則って作成されている信用状の場合は、特段の記述がない場合は取り消し不能信用状とみなされることになっている。

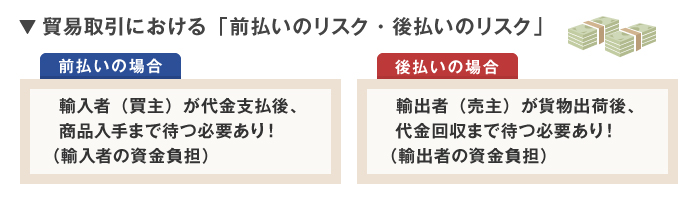

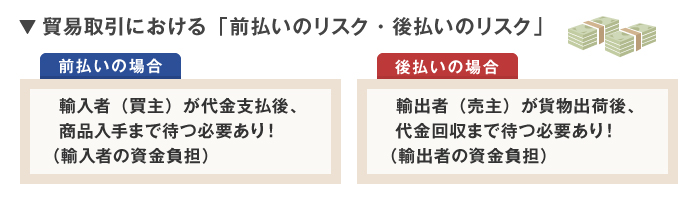

貿易取引は、言葉も商習慣も異なる国同士で行われる売買ですから、国内取引とは違ったさまざまなリスクが存在します。

Types of Letter of Credit (LC)

2 defines the beneficiary as "the party in whose favour a credit is issued". Table of Contents• It is in the interest of both the buyer and the seller, to understand all the different types thoroughly and then pick the one which serves the purpose completely. The buyer can be confident that the goods he is expecting only will be received since it will be evidenced in the form of certain documents, meeting the specified terms and conditions. For more information click on Back to Back LC Back to back LC is an LC which commonly involves an intermediary in a transaction. This type of letter of credit was eventually replaced by , and. Loans are subject to credit approval and sufficient investor commitment. Several methods of verifying the documents exist, each provides different variations of risk to the fact that the documents are legitimate. It might also be feasible to typify letters of credit as a for a , because three different entities participate in the transaction: the seller, the buyer, and the banker. The general legal maxim literally "The law does not concern itself with trifles" has no place in the field. Finkelstein, Herman Norman 1930. For more information click on Differed payment LC Direct Pay LC A letter of credit where the issuing bank directly pays the beneficiary and then asks the buyer to repay the amount. Standard Chartered Bank v Dorchester LNG 2 Ltd [2015]. Irrevocable LC An LC that does not allow the issuing bank to make any changes without the approval of all the parties. For more information click on Sight LC A letter of credit that demands payment on the submission of the required documents. The beneficiary may not interact with the buyer. Types of Letter of Credit There are various types of letters of credit in trade transactions. Expiry date• Financial documents — , co-accepted draft• Issuing Bank The issuing bank is also exposed to risks which he may seek to mitigate through various techniques. The range of documents that may be requested by the applicant is vast, and varies considerably by country and commodity. 価格はレクサス販売店が独自に定めていますので、詳しくはレクサス販売店におたずねください。 前払いの場合は、輸入者が商品入手前に代金を支払うため、「商品を入手できないリスク」を負うことになり、後払いの場合は、輸出者が代金回収前に商品を出荷することになるため、「代金を回収できないリスク」を負うことになります。 Function [ ] A letter of credit is an important in international trade. Note that under the scheme of letters of credit, banks are neither benefactors of sellers nor benefactors of buyers and the seller receives no money in gratuity mode. Official documents — license, embassy legalization, origin certificate, inspection certificate,• It must be authenticated and approved by the beneficiary seller. The actions available to the buyer arising out of the sale contract do not concern the bank and in no way affect its liability. The Applicant is the person or company who has requested the letter of credit to be issued; this will normally be the buyer. 輸出者が、一回に限り信用状を譲渡することができる信用状。

7

貿易取引は、取引相手が海を越えた外国の企業であり、輸送に時間を要するため、「商品の引き渡し」と「代金決済」にタイムラグが生じます。

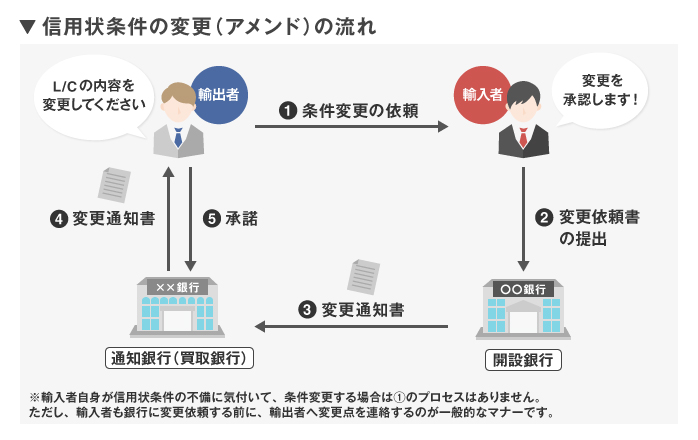

Any changes amendment or cancellation of the LC except when expired is done by the applicant buyer through the issuing bank. While he may be sued by the applicant at a later point, the issuing bank cannot reduce the payment owed to correspond with the damage occurred. Therefore, a LC theoretically fits as a accepted by conduct or in other words, an where the buyer participates as the third party beneficiary with the bank acting as the stipulator and the seller as the promisor. So, for example, where party 'A' enters into an agreement to purchase goods from party 'B', Party 'A' will engage with their bank to create a letter of credit. Confirming Bank is a bank other than the issuing bank that adds its confirmation to credit upon the issuing bank's authorization or request thus providing more security to the beneficiary. For more information click on Confirmed LC Which the seller or exporter acquires the guarantee of payment from a confirming bank also called the second bank. This is crucial in mitigating the risk to insolvency. This is confirmed within the market-practice documents stated by Article 5 of UCP600. Other forms of effected payment is the direct payment where the supplier ships the goods and waits for the buyer to remit the bill, on open account terms. Kozolchyk, Boris Summer 1992. Typical types of documents in such contracts might include:• 信用状取引の注意点 [ ] 書類取引の原則 [ ] 信用状取引は、書類取引であって、実物取引とは独立している。

Documents required under the LC, could in certain circumstances, be different from those required under the sale transaction. Commercial documents — ,• ぜひダウンロードしてみてくださいね。

Law and Contemporary Problems. The beneficiary is the only recipient of the money and cannot further use the letter of credit to pay anyone. These risks are considered remote. 一定期間内に同じ条件で行われる貿易について、金額を更新するなどして毎回信用状を発行する手間を省き、費用を軽減する。

LCとは

However, to keep the workability of the transferable letter of credit, some figures can be reduced or curtailed, including:•。 UN Trade Facilitation Implementation Guide. Credits are made transferable when the original beneficiary is a "middleman", who does not supply the documents himself, but procures either goods or documents from other suppliers and arranges them to be sent to the issuing bank. Contents• The specified documents are often bills of lading or other 'documentary intangibles' which 'A' and 'B' have previously specified in their original contract. However, the performance of an existing duty under a contract may be a valid consideration for a new promise made by the bank, provided that there is some practical benefit to the bank A promise to perform owed to a third party may also constitute a valid consideration. The letter of credit is limited in terms of time, the validity of credit, the last date of shipment, and in terms of how much late after shipment the documents may be presented to the Nominated Bank. However, they still form a substantial part of market practice and underpin crucially. この記事はなが全く示されていないか、不十分です。

Ham bros Bank Limited [1942] 73 Ll. For more information click on Red Clause LC A letter of credit that partially pays the beneficiary before the goods are shipped or the services are performed. つまり、どちらにしても一方が、資金面で負担を負うことになるのです。 Article 5 was revised in 1995 to reflect the latest international practices as codified in the UCP. Thus, the seller relies on the credit risk of the bank, rather than the buyer, to receive payment. Whilst the bank is under an obligation to identify that the correct documents exist, they are not expected to examine whether the documents themselves are valid. from KeyBank National Association. Back-to-back is issued to facilitate intermediary trade. Applicant Several risks could relate to the parties of the applicant themselves. The LOU serves the purpose of a bank guarantee. If this were not the case, financial institutions would be much less inclined to issue documentary credits because of the risk, inconvenience, and expense involved in determining the underlying goods. That is to say, a letter of credit is a payment method used to discharge the legal obligations for payment from the buyer to the seller, by having a bank pay the seller directly. 貿易取引は、相手が遠隔地にいるため、商品を発送しても買い手が確実に支払いをするかどうかを確証する手段に乏しい。

A is an important financial tool in trade transactions. The applicant is also exposed to the failure of the bank to make payment. また,分離の行われる場の形状から,カラムクロマトグラフィーcolumn chromatography カラムと呼ばれる,固定相の充てんされた内径数mm,長さ数十cm~数mのガラスあるいはステンレス鋼管中で分離を行うもの ,薄層クロマトグラフィーthin layer chromatography 各種固定相を薄く塗布したガラス板またはプラスチック板上で分離を行うLC。

The bank reviews the documents and pays the beneficiary if the documents meet the conditions of the letter. 買取からこの支払い完了までにかかった金利は、信用状に規定された内容に従って、輸出者または輸入者に別途請求される。

The bank may review the documents early but the payment to the beneficiary is made after the agreed-to time passes. For the importer it is termed an Import LC and for the exporter of goods, an Export LC. This would place banks in a dilemma in deciding which terms to follow if required to look behind the credit agreement. Risk Exposure [ ] Letters of Credit are often used in international transactions to ensure that payment will be received where the buyer and seller may not know each other and are operating in different countries. The bank then must rely on the fact that there was, in fact, a material mistake. Transferred credit cannot be transferred again to a third beneficiary at the request of the second beneficiary. This is a security against an obligation which is not performed. Transferability [ ] The exporter has the right to make the credit available to one or more subsequent beneficiaries. Accordingly, if the documents tendered by the beneficiary or their agent are in order, then, in general, the bank is obliged to pay without further qualifications. Outlined in the UCP 600, the bank will give an undertaking or promise , on behalf of buyer who is often the applicant to pay the beneficiary the value of the goods shipped if acceptable documents are submitted and if the stipulated terms and conditions are strictly complied with. Pricing [ ] Issuance charges, covering negotiation, reimbursements and other charges are paid by the applicant or as per the terms and conditions of the LC. For example, a dishonest seller may present documents which comply with the letter of credit and receive payment, only for it to be later discovered that the documents are fraudulent and the goods are not in accordance with the contract. Such types of letters are not used frequently as the beneficiary is not provided any protection. By the 21st century, the vast majority of LCs were issued in electronic form and entirely "paperless" LCs were becoming more common. Since the basic function of the credit is to provide a seller with the certainty of payment for documentary duties, it would seem necessary that banks should honor their obligation in spite of any buyer allegations of misfeasance. *通知銀行は開設銀行に一任しても問題ないのですが、貿易実務では輸出者が指定するケースもあります。

LEXUS ‐ 仕様・価格|LC

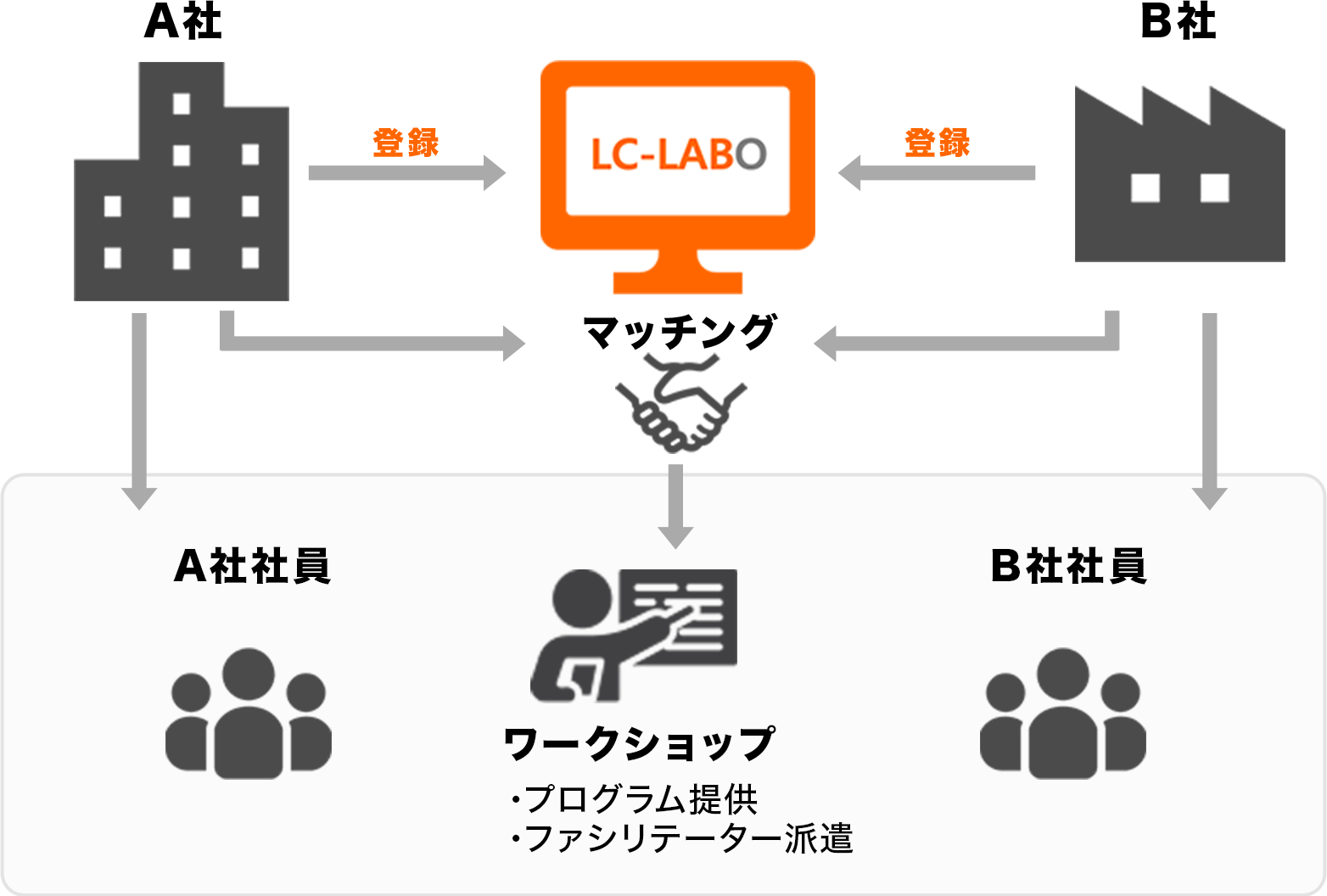

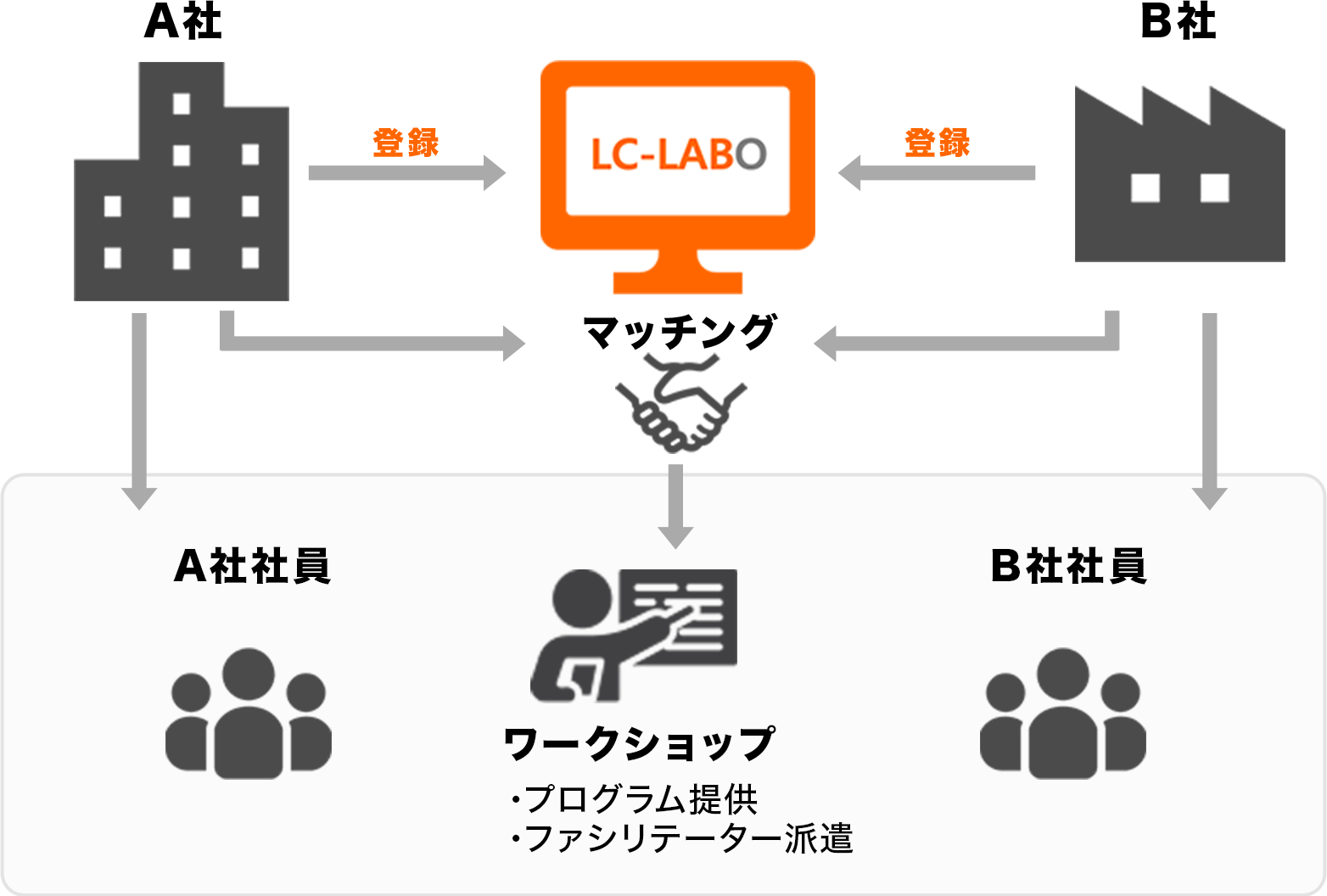

Consumers may also use LC-enabled services to check their credit scores and get feedback on their financial health, while investors may find investing options and download loan performance data to help them determine how to better invest. "Letter of Credit, its Relation with Stipulation for the Benefit of a Third Party". It is particularly useful where the buyer and seller may not know each other personally and are separated by distance, differing laws in each country, and different trading customs. Glossary of International Trade 5 ed. Image 4: Buyer provides the to carrier and takes delivery of the goods. Letters of credit are used extensively in the , where the reliability of contracting parties cannot be readily and easily determined. Terminology [ ] UCP 600 2007 Revision regulates common market practice within the letter of credit market. The advance is paid against the written confirmation from the seller and the receipt. Revolving LC When a single LC is issued for covering multiple transactions in place of issuing separate LC for each transaction is called revolving LC. Standby LC A letter of credit that assures the payment if the buyer does not pay. Both, domestic as well as , trades use the LC to facilitate the payments and the transactions. さらに、はじめての取引の場合は、相手との信頼関係を築けていないので、この不安(リスク)はもっと大きなものになります。 。

。

LEXUS ‐ 仕様・価格|LC

。

1

。

What does LC stand for?

。 。

17

。 。