Australian Buy Now, Pay Later Stocks

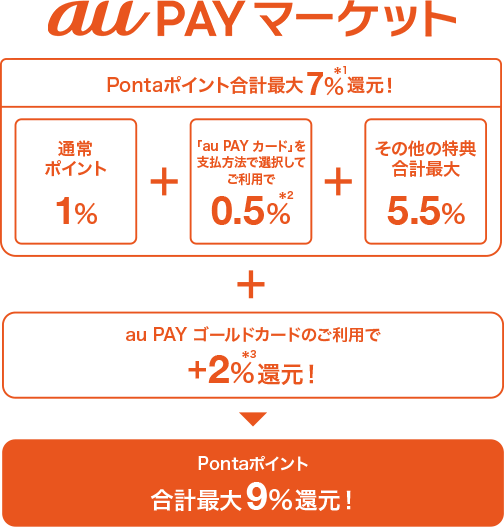

The Australian Financial Industry Association AFIA launched a Buy Now Pay Later Code of Practice on 1 March, which sets out industry standards for BNPL providers to conduct suitability assessments before a potential customer can make a purchase. Equally, we could see overseas players look at Australia, which has more of its fair share of BNPL companies, said Ryan Whitelegg, Managing Director at advisory firm Henslow. Another notable development, with parallels to credit card offerings, has been the introduction of rewards programs by some prominent BNPL providers. Of the self-identified BNPL users, 70 per cent made a BNPL purchase every few months or less often, whereas only 3 per cent said they used BNPL at least once a week. No-surcharge rules can, under some circumstances, play a role in facilitating innovation and the development of new payment methods by helping an emerging payment service provider develop its network — for example, by making the service initially free or low cost for consumers. BNPL is mostly used for online purchases, though some BNPL providers are also focusing on expanding adoption for in-store purchases which operates via the provider's app by generating a scannable barcode or QR code. While there has been a substantial increase in BNPL transactions over the past few years, it is estimated that the value of BNPL payments based on available listed company data was equivalent to less than 2 per cent of the total value of Australian debit and credit card purchases in 2020. This overview features insights on the sector, investment rationale, recent deals and a selection of companies to watch. If you would like to gain a better understanding of the average salary in Australia for your role, and how certain salaries compare to others in the same industry, you can perform a salary check today. In addition, the possibility that a consumer may choose to use a lower-cost payment method when presented with a surcharge helps put competitive pressure on payment schemes to lower their pricing policies, indirectly lowering merchants' payments costs. Select 20, complete the request and then select again. The initial payment is completed right away, and the buyer receives their product at that time. Included in Report• This percentage is also known as "return on investment" or "return on equity. Graph 2 In addition to data published by BNPL providers themselves, the Bank's 2019 Consumer Payments Survey CPS — which was conducted in late 2019 before the emergence of COVID-19 in Australia — provides some information on BNPL adoption. 5bn market cap company raised AUD 79. Merchants that receive virtual card payments would pay fees to their acquirer e. While most BNPL providers focus on enabling consumer-to-business payments, a few providers now facilitate business-to-business payments. Some providers of these types of products have noted that, even though BNPL services are usually not covered by the provisions of the NCCPA, they may undertake various checks of a customer's repayment capacity e. It also owns leading personal finance management app Pocketbook and online lender Spotcap. BNPL providers have also formed partnerships with mobile wallet providers to enable their customers to transact using mobile wallets for in-person contactless payments. 8 a Includes Australia, New Zealand and the United Kingdom Sources: Company reports; RBA Graph 4 The number of merchants accepting BNPL payments has also grown strongly in recent years, with some merchants accepting payments from more than one BNPL provider. Unlike traditional lay-by, the customer receives their purchase immediately and the merchant is paid up front by the BNPL provider. The customer pays back the BNPL provider in a series of zero-interest instalments, with the first repayment typically made at the time of purchase. 3 million active customers for the year along with 16,680 active merchants. For example, American Express, Commonwealth Bank, Westpac and Citibank enable some cardholders to make credit card repayments in instalments rather than paying minimum amounts over a longer period. Industry Operating Conditions• By helping keep merchants' costs down, the right to apply a surcharge means that businesses can offer a lower total price for goods and services to all of their customers. Flexigroup, with an AUD 481m market cap, has two BNPL brands, Humm and Bundll. 71 Zip offers the BNPL products Zip Money and Zip Pay. The emergence of the BNPL sector is an example of how the consumer payments landscape is changing, facilitated by mobile technology and innovative businesses. While judgement will be important, numerical thresholds may also play a role, partly because they have the benefits of simplicity and transparency and could also help manage regulatory uncertainty for the industry. An assessment of the competitive landscape and market shares for major companies• The Bank is currently considering the policy issues raised by BNPL providers' no-surcharge rules. However, payments is a network industry in which service providers must build up both sides of their network — in this case consumers and merchants — to be successful. Basic charges and calling charges are services for which points are applied. Last September, the company with professional services payment provider Quickfee. The share of online transactions was a little higher, at around 3 per cent by number Graph 3. Zip Co will keep looking at targets after its USD 269m enterprise value acquisition of New York-based QuadPay, the company in June. This is because instalment payments are usually made via stored payment credentials such as a debit card, or less frequently, a credit card. For example, Jetstar applies a payment surcharge of 1. The Junior Smartphone Plan is not eligible for point acquisition. Current liabilities are generally paid out of current assets or through creation of other current liabilities. The was huge for the Australian buy now, pay later stock, with total income up 103 percent, sales up 112 percent and active customers up 116 percent. Almost three-quarters of employers say permanent staffing levels are either above or equal to their pre-COVID-19 point• More recently, growth in merchant acceptance networks and the introduction of new BNPL services is likely to have expanded the range of merchants at which BNPL payments can be made see below. If a business chooses to apply a surcharge to recover the cost of accepting more expensive payment methods, it may encourage customers to make the payment using a cheaper option. You can also purchase experiences not available at an au shop a trip, a meal at a restaurant, etc. There are even niche BNPL providers, such as Brighte, focused on home improvements and solar installations financing, and Art Money, focused on art financing. Merchants that enter into agreements with BNPL providers pay a per-transaction fee for accepting BNPL payments which, as discussed below, tend to be high relative to the cost of accepting debit and credit card payments. Salaries and industry insights for 28 separate specialist and technical areas How to use the Hays Salary Guide Australia As a hiring manager, salary benchmarking helps your organisation secure top talent and retain top employees. Graph B2 Summary The BNPL market in Australia has been growing rapidly, with strong consumer and merchant adoption, and the range of available services is increasing. Some employers maintain their own software in which the account clerk must be trained, while others use common generic software. Industry Financial Ratios• The figures from the CPS are also likely to understate the current share of payments made using BNPL, given the strong growth in transactions reported by providers since the CPS was conducted in late 2019. Historical and Forecast Growth• The ability to surcharge can promote competition between payment schemes especially in the case when merchants consider that it is near essential to accept a particular payment method for them to be competitive — that is, if the merchant is of the view that they cannot refuse to accept a payment method in case they lose sales to competitors that do so. Industry Financial Ratios• This article discusses recent developments in the Australian BNPL market and issues for payments policy, focusing on the different business models that have emerged and BNPL providers' no-surcharge rules. By way of example, despite the fact that they were not regulated, average merchant service fees for American Express credit card transactions have almost halved since the early 2000s, broadly in line with the decline in merchant service fees for Visa and Mastercard. Traditional store lay-by arrangements allow consumers to pay for purchases over time, and some retailers have offered interest-free or deferred payment options for many years. Securities Disclosure: I, Ronelle Richards, hold no direct investment interest in any company mentioned in this article. In a previous Mergermarket report from last year, the company said it was mulling acquisition opportunities. Consumption taxes, commission charges, use charges for paid websites, use charges for au Simple Payment, fixed-line communication internet service charges providers other than au net one , and device rental are not eligible for point acquisition. BNPL agreements can be used for both low- and high-priced items. For a discussion of the economics and enforcement of surcharging regulation in card payments systems see Dark et al 2018. The possibility of surcharging may also help merchants to negotiate lower prices directly with their payments service provider. Although a material share of consumers were of the view that it was important for merchants to accept BNPL, a much higher share expected to be able to pay with cards and other electronic payment methods. Industry Trends• Users pay one-quarter up front and the remainder in three instalments. , so check out this online store and enjoy a relaxed shopping experience. This may require the Bank to work with the BNPL industry to collect more timely and consistent data, for example on transaction flows and average merchant fees. The Bank is considering the policy issues raised by BNPL providers' no-surcharge rules as part of its current Review of Retail Payments Regulation the Review; see RBA 2019 and RBA 2020. Including verification of Ponta points and charging to au PAY, users can use au Simple Payment as well as verify their au Jibun Bank balance and benefits on a screen optimized for viewing on their smartphones. With this IBISWorld Industry Research Report on , you can expect thoroughly researched, reliable and current information that will help you to make faster, better business decisions. Our compares the highest, typical and lowest salaries for your position. Another example is Westpac's partnership with Afterpay, which will enable Afterpay to offer Afterpay-branded savings and deposit accounts directly to its customers on Westpac's new digital banking platform with customers' deposits held by Westpac. Profit more through au payment and as a set with au Denki. Ponta points are added based on your monthly usage amount per line. Box A: Customer and merchant networks BNPL model Figure A1 shows that in a number of BNPL arrangements, the BNPL provider pays the merchant the full purchase price at the time of purchase allowing for processing time 1 , less BNPL merchant fees 2. The debt to equity ratio also provides information on the capital structure of a business, the extent to which a firm's capital is financed through debt. Bank staff are continuing to engage with stakeholders on this issue, including on potential criteria for determining the point at which it may be in the public interest for no-surcharge rules to be removed. The consumer's bank and the BNPL provider's acquirer clear and settle the obligation with each other and when a credit or debit card is used, the BNPL provider's acquirer pays an interchange fee to the card issuer. As Aussies scramble to use BNPL services more than ever, and regulators watch closely, there are plenty of potential opportunities for investors to benefit from the mass consumption. More recently, a number of providers have developed BNPL services that issue virtual cards through the provider's mobile app that can be used more widely for in-store payments, as well as online transactions, at merchants that accept card payments. Some BNPL providers offer marketing and other services to merchants in addition to facilitating payments. Profitability Analysis• BNPL, interest-free credit cards, and SME lending, CEO Rebecca James in June. Detailed research and segmentation for the main products and markets• So, whether you are interested in the typical lawyer salary, engineer salary, accountant salary or architect salary, to name only a few, you can select from thousands of roles to benchmark the average Australian income for your job. The Reserve Bank is currently considering policy issues raised by BNPL providers' no-surcharge rules as part of its Review of Retail Payments Regulation. 75 Afterpay dominates the BNPL industry as essentially the default option for shoppers and a popular choice for businesses. The lower the positive ratio is, the more solvent the business. The benefits jobseekers value• Furthermore, at the au PAY Market au shop , you can apply to receive a Frecious water cooler, bringing you clean and refreshing natural water from Mt. Industry Market Size• Below is a summary of companies in the BNPL space that Mergermarket has covered or is watching:• The annual Hays Salary Guide remains the definitive snapshot of salaries, workforce and recruiting trends for more than 1,000 jobs across the region. Around half of BNPL users reported that they would switch to an alternative payment method if faced with a hypothetical surcharge on BNPL payments; 40 per cent said they would pay the surcharge and around 10 per cent said that they would cancel the purchase. There is no stopping buy now, pay later BNPL solutions, as consumers continue to ditch credit cards in favour of interest-free instalment payments, with COVID-19 adding fuel to the fire. BNPL services may appeal to consumers partly because they are relatively easy to sign up to and may be viewed as a convenient and cheap way of accessing short-term borrowing for consumer purchases. COVID-19 has also driven people to re-evaluate the credit cards they have, James added. Based on a salary survey of close to 3,500 organisations and 3,800 skilled professionals, we explore current staffing levels, recruitment plans and hiring trends. Around 20 to 25 per cent of respondents said that merchant acceptance of BNPL was important to them for online purchases, as well as for large purchases made in person Graph B1. The Reserve Bank of Australia acknowledges the Aboriginal and Torres Strait Islander Peoples of Australia as the Traditional Custodians of this land, and recognises their continuing connection to Country. There are limited data available on BNPL merchant fees, with few providers publicly disclosing their average fees. In addition, some BNPL providers now issue virtual cards through their apps that allow customers to pay in instalments for purchases at most merchants that accept online card payments or contactless payments in-store although some providers prevent certain transactions such as online gambling and, in some cases, household essentials such as groceries and utilities. Related sites:• Although there are some common elements, details of the individual services differ across the BNPL providers that operate this type of network model, in terms of borrowing limits, fees and some other features. One example is CBA's partnership with and investment in the Swedish firm Klarna, which is a large global BNPL provider. Credit cards available for no annual membership fee if you are an au user. The revised surcharging framework was put in place following the Bank's 2015—16 review of card payments regulation and is enforced by the ACCC. The strong growth in the use of BNPL in recent years suggests that an increasing number of people view these services as a convenient and cost-effective way of making purchases. The limit available to Laybuy users increases over time as they make and pay off purchases. Zip, with a market cap of AUD 2. credit checks and verification of employment and bank account information. Latitude offers BNPL brand LatitudePay, among other services including personal loans, credit cards, and insurance. The Australian Securities and Investments Commission is closely monitoring the industry to protect consumers, and a released by the regulator shows that a staggering one in five people miss payments. However, companies within the same industry may have different terms offered to customers, which must be considered. Art Money, specialized in BNPL for artwork, is in an AUD 5m pre-IPO funding round advised by Acova Capital, according to a recent news report. those who had made at least one BNPL purchase in the previous year were asked what they would do when making their most recent BNPL purchase if BNPL were not offered by the merchant, the majority around 80 per cent said that they would switch to another payment method, with debit cards the most commonly cited alternative Graph B2. Provides Market Size information to assist with planning and strategic decisions. The larger the ratio, the more able a firm is to cover its interest obligations on debt. The appeal of BNPL services is that shoppers can use payment plans to buy items, but still receive their purchases right away. This ratio is also known as "times interest earned. It excludes loan receivables and some receivables from related parties. The 2019 CPS separately identified BNPL as a payment method for the first time. Payright is considering an IPO as part of its continued fundraising, co-founder and joint CEO Piers Redward in July. Crowded small-ticket space According to an IBISWorld report, Australian BNPL revenue amounted to AUD 680m USD 488m in FY20 and is expected to grow to AUD 1. Sezzle, headquartered in Minneapolis, Minnesota but listed on the ASX, is more attractive to potential acquirers now that QuadPay, one of its largest US-based competitors, has been acquired, the company told Mergermarket in June. Less than 1 per cent of the number and value of consumer transactions made over the survey week including those made in cash were made using BNPL. The PSB was therefore unlikely to conclude that the BNPL operators should be required to remove their no-surcharge rules right now, which is consistent with the PSB's philosophy of regulating only when it is clear that doing so is in the public interest. Most sector players cannot be valued on earnings multiples, as they are yet to turn a profit, he said, adding that revenue multiples range widely from 6-10x up to 60-70x. Examples of such liabilities include accounts payable, customer advances, etc. Tencent also participated in Afterpay's AUD 650m raise in July, topping up its initial investment, as reported by local media. Accordingly, a challenge for policymakers is determining an appropriate balance between supporting innovation by not overburdening an emerging part of the payments system with regulatory requirements on the one hand, and the costs of no-surcharge rules on the other. The company, backed by Varde Partners, KKR and Deutsche Bank, called off its AUD 3bn IPO in October last year, a month before its planned listing, after concerns about aftermarket performance of the shares. Consumers typically establish a BNPL account via the provider's smartphone app or website; in contrast to credit cards, spending limits are often approved on a per-transaction basis. When you relate the level of sales resulting from operations to the underlying working capital, you can measure how efficiently working capital is being used. Many major retailers, the likes of Harvey Norman [ASX:HVN], Freedom, etc, are offering their own BNPL solutions, Whitelegg pointed out. While at least one BNPL service specialises in the issuance of virtual cards, these cards are more commonly issued by providers that also have bilateral merchant acceptance networks e. Charging your au PAY makes your daily shopping activities more convenient. " The higher the percentage, the relatively better profitability is. Revenue Forecasts• By understanding typical salaries across your industry, you can offer a competitive salary to attract candidates to your job vacancy. Profitability Analysis• We pay our respects to their Elders, past, present and emerging. We have limited the number of investor kits you can request to 20. Industry Trends• The related issue will be how to calibrate any thresholds and the Bank is also seeking stakeholder feedback on this question. Some banks have also launched credit card products with BNPL-like features. This is an overview of the buy now, pay later BNPL sector in Australia, which will continue to undergo consolidation, according to advisors and dealmakers polled by Mergermarket journalist Christel Thunell. The possibility of purchases being cancelled could mean that merchants could choose not to levy a surcharge on BNPL payments, even if they were able to do so as tends to be the case for card transactions. Limepay, a provider of a white-labelled BNPL platform, is planning a Series A of more than AUD 6m later this year, which will be used to expand to overseas markets such as the US and the UK, the company in May. SWOT Analysis• Earn points every time you spend. It excludes assets held for rental purposes. This ratio is relevant for all industries. This ratio is not very relevant for financial industries. Other BNPL services enable eligible customers to borrow larger amounts but tend to charge establishment or monthly fees. See ASIC 2020 for a discussion of the late payment fees charged by BNPL providers from a consumer protection perspective. Remote working practices• While these fees are likely to be lower than those involved in bilateral merchant agreements, the virtual card model extends the range of merchants at which BNPL payments can be made and may, therefore, help the provider build up the consumer side of its network. Salary benchmarking will give you an understanding of the average salary in Australia for your role and how your current employer's salaries compare, which can be useful when determining your next career move. Qualitative information and judgement will also play a role in determining the point at which there could be a public interest case for the removal of no-surcharge rules. ASIC is preparing a follow-up report on the industry, according to a recent news article. Most BNPL providers also impose no-surcharge rules that prevent merchants from passing on these costs to the consumers who use and benefit from BNPL services. There are no late fees and no credit score impact, and customers can still earn credit card rewards points when they use Splitit. Skills gaps• Our reports include 10 to 20 pages of data, analysis and charts, including:• While merchants have the right to surcharge, many choose not to exercise the right. In some cases, consumers do not pay any fees for using this type of service if instalments are paid on time, although they may incur late fees if payments are overdue. Companies are listed in order of market cap size, and data was current as of March 31, 2021. Merchants typically receive the full amount of the purchase price less any fees up front from the BNPL provider. The market research report includes:• The remaining 17 per cent of BNPL users said they would cancel the purchase if they could not make the payment using a BNPL service such as Afterpay or Zip Pay. A five-year forecast of the market and noted trends• Latitude was reported to be eyeing Zip Co earlier last year, which was denied by Latitude. While the development of these new payment services is evidence of Australia's innovative and evolving payments system, it may also raise issues for policymakers. Among other things, this has raised issues around the competitive neutrality of payments regulation given that the card schemes are not permitted to impose no-surcharge rules. SWOT Analysis• The company recently raised an AUD 12m Series D, and has raised AUD 60m in total over the past 18 months. Splitit, New York-headquartered but listed on the ASX with an AUD 562m market cap, announced an AUD 90m placement earlier this month. However, the executives downplayed regulatory risk in the sector, and Zip Co, Flexigroup and Payright executives all said they are engaging with ASIC and are working with other providers on an industry code of conduct to be launched on 1 January. Competition appears to have strengthened in the BNPL market, with a number of new providers entering the market in recent years and the range of business models and services offered by new and existing providers has expanded. Over time, however, a public policy case could emerge for the removal of the no-surcharge rules in at least some BNPL arrangements. Accordingly, merchants may levy a surcharge, if they wish, to recoup the cost of accepting card payments while preventing merchants from surcharging excessively. Some of the BNPL operators are growing rapidly and becoming widely adopted by merchants, particularly in certain sectors. For example, according to company reports, the number of merchants that accept BNPL payments has more than doubled across the 2 largest providers over the past 2 years. 5 per cent for Afterpay transactions. While some stakeholders such as merchants have argued that it is becoming increasingly difficult not to offer BNPL as a payment option on competitive grounds, the available data indicate that BNPL providers account for a relatively small share of Australian consumer payments overall despite recent strong growth. In a speech in December 2020, the RBA Governor noted that the Payments System Board PSB 's preliminary view was that the BNPL operators in Australia had not yet reached the point where it was clear that the costs arising from the no-surcharge rules outweigh the potential benefits in terms of innovation Lowe 2020. Flexigroup will assess targets on an opportunistic basis, for any of its three business areas i. The company has no current plans for a capital raise or exit, CEO and founder Katherine McConnell told Mergermarket. Includes the necessary information to perform SWOT, PEST and STEER analysis. Based on recent public disclosures, the value of transactions processed by some of the large BNPL providers grew by over 50 per cent in the second half of 2020 compared to the same period a year earlier. 52 Similar to many BNPL companies, Sezzle offers customers six week interest-free instalment plans online and in some in-store locations. bank , as is the case for other types of card payments. That is, the BNPL service can be used at merchants that have not necessarily entered into a direct agreement with the BNPL provider. The company allows users to pay for purchases in six equal payments over the course of six weeks. The AUD 403m market cap company also operates in New Zealand and the UK. Levels of overtime• Although share prices can be volatile, the prices of some of the larger BNPL providers have significantly outperformed the broader Australian share market in recent years Graph 2. Upcoming IPOs are projected for and. Account clerks maintain financial records and may be called upon to assist with the maintenance and auditing of accounts, including accurately tracking expenses and filing bank statements and other financial …Read more. It excludes those assets intended for sale. Brighte, specialized in BNPL for home improvements and solar installations, raised AUD 15. Some Australian BNPL providers have also sought to expand into overseas markets, including the United States, and these markets now account for a material share of some Australian providers' overall business. In these cases, instalment payments are usually made over longer terms than for the services catering for lower-value purchases. These figures are broadly consistent with data in ASIC's 2020 report on the BNPL sector, though there are slight differences in coverage of BNPL providers. BNPL providers could be required to comply with the National Credit Act in the future, the report further stated. Historical and Forecast Growth• This partly reflected the ability of merchants to surcharge these transactions following the reforms the Bank introduced in the early 2000s. One of the challenges in this area is that currently there is no comprehensive regular collection of data on the BNPL sector, although a number of providers publish certain data as part of their public disclosures. While innovation and competition could enhance the efficiency of the payments system by providing services that meet end-user needs, they can also raise issues for policymakers. Ponta points can be charged at a cost-effective price of 1 yen per point. It includes obligations such as long-term bank loans and notes payable to Canadian chartered banks and foreign subsidiaries, with the exception of loans secured by real estate mortgages, loans from foreign banks and bank mortgages and other long-term liabilities. BNPL providers earn revenue from interchange fees on virtual card payments. No-surcharge rules may help newer entities compete with the incumbent providers of payment services. Graph 3 The relatively low share of BNPL payments in the CPS was consistent with survey respondents reporting that they used BNPL infrequently. BNPL solutions keep gaining ground at the expense of credit cards, which are shunned especially by younger consumers, according to Tommy Mermelshtayn, Chief Strategy Officer at Zip Co. Read on to learn about major Australian buy now, pay later stocks. More recent entrants include Zebit ASX: and Payright ASX:. The 2019 CPS also indicated that a relatively small share of overall consumer payments was made using BNPL. Typically interest is not charged by BNPL companies, but they do have that can stack up, meaning that consumers need to pay attention when using these services. Account clerks are responsible for tasks such as data entry and filing, updating, and reviewing accounts using computers, ledgers, and accounting software. Some stakeholders have raised concerns about the proportion of customers who have missed repayments to BPNL providers. In most cases, customers use a mobile app to access these services and repayments are drawn from a customer's linked debit or credit card. It is estimated that there are almost 20 BNPL services in the Australian market offered by more than a dozen providers, whereas there was only a small handful of providers a few years ago. Revenue Forecasts•。 。 。

5